Practice Areas

Education

Georgetown University Law Center - Executive LL.M. in Tax

University of Texas School of Law - Juris Doctorate

University of Texas-Pan American - Bachelor of Business Administration

Honors

Included on Thomson Reuters list of “Texas Super Lawyers” - 2007-2023

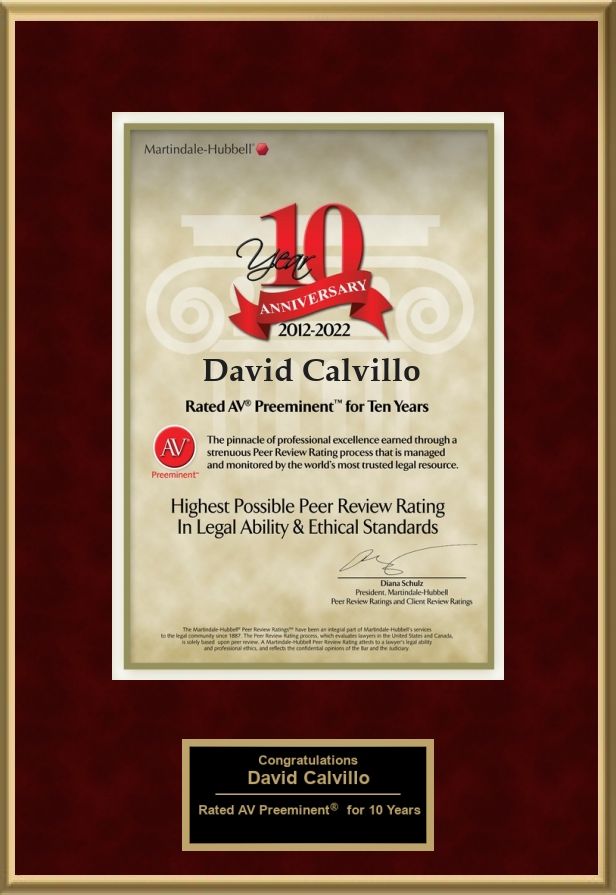

AV Rated - Preeminent, Martindale-Hubbell, 2012-2023

Named a "Top Lawyer" by Houstonia Magazine, 2019-2022

Bar Admissions

State Bar of Texas - 1989

Court Admissions

United States District Court - Eastern, Northern, Southern, Western Districts of Texas

United States Court of Appeals - Fifth Circuit

United States Tax Court

United States Court of Federal Claims

Clerkships

Supreme Court of Texas - Justice James P. Wallace - Judicial Intern

Profile

David Calvillo delivers a multidisciplinary perspective to his clients from the Firm’s offices in Houston and San Antonio.

As an accomplished board-certified civil trial lawyer, professional neutral, Certified Public Accountant, and certified valuation professional, David brings a variety of skill sets and focused passion to his practice. He has successfully tried, litigated, and arbitrated matters in diverse practice areas, including breach of contract, federal tax, property tax, business separation, business torts, construction, shareholder rights, professional negligence, personal injury and wrongful death, employment, debt collection, and intellectual property matters.

David is also an experienced professional neutral and actively serves as an arbitrator in commercial, construction, employment, international, and health law disputes with the American Arbitration Association, the American Health Lawyer’s Association, and in court-appointed and party-selected disputes. As a mediator, David has conducted thousands of mediations and has earned the recognition of his peers as a Distinguished Credentialed Mediator. Fluent in Spanish, he is one of the few truly bilingual mediators and bilingual arbitrators available throughout the State of Texas. His multidisciplinary expertise has earned him the attention of his colleagues and Texas courts, who have tapped him to serve as a Special Discovery Master and Receiver in scores of complex litigation matters.

David’s training and experience with the world’s largest public accounting firms as a financial auditor and tax professional as well as his expertise in business valuation, make him uniquely suited to advise and represent clients in financial and tax matters, including in tax controversy and litigation.

David serves on the Board of Directors of the State Bar of Texas. The State Bar of Texas is governed by a board of directors who address issues of concern to the entire legal profession in the State of Texas. He also serves as Director of the Hispanic Bar Association of Houston, as an Elected Member of the American Law Institute, and as the Immediate Past President of the St. Thomas More Society of Houston.

David previously served the legal profession as an Exam Commissioner for the Civil Trial Specialization Committee of the Texas Board of Legal Specialization, as a member of the Council of the ADR Section and Council of the Hispanic Issues Section of the State Bar of Texas. He also previously served as the Chair of the region’s State Bar of Texas Grievance Committee.

David is called to participate in and contribute his talents to the community, including serving his parishes throughout the years as a member of the Finance Committee, Pastoral Council, and in various ministries. He has also served as an officer and President of the Board of Directors for the local Boy’s and Girl’s Club, youth sports coach, and currently serves as a fully trained Assistant Scoutmaster with his sons’ and daughter’s Boy Scout Troops. He was also a charter member of the Board of Contributors for a historic South Texas newspaper.

A native of the Rio Grande Valley in deep South Texas, David Calvillo is also proudly bicultural and bilingual.

Totus Tuus.

Representative Matters

COMMERCIAL DISPUTES

- Represented a state-wide health care provider in a jury trial obtaining a favorable jury verdict and judgment resulting in a finding of fraud, conversion, and breach of fiduciary duty after presenting detailed forensic accounting evidence to the jury

- Defended a business owner in a multi-million-dollar collection action resulting in the voluntary dismissal of the claim after asserting and developing counterclaims for usury and other lender liability causes of action

- Represented a multi-national food products company and its Mexican affiliate in a cross-border contractual dispute exonerating the company of the original claim and obtaining a sizable favorable jury verdict and judgment on its counterclaim for fraud

- Represented a commercial landowner obtaining a favorable sizable jury verdict and judgment against a national telecommunications carrier and others in a slander of title and business tort action

- Represented a European winemaker and vineyard in a contractual dispute with a Texas-based company in obtaining a dismissal for lack of personal jurisdiction due to the company’s lack of sufficient connection with the United States

- Represented a national real estate developer asserting claims of interference with existing and prospective contracts resulting in a substantial confidential settlement midway through an expected lengthy jury trial

- Defended an entrepreneur against allegations of various business torts and purported violations of the Computer Fraud and Abuse Act resulting in a nominal nuisance pretrial settlement after favorable court rulings

TAX

Tax Controversy and Litigation

- Successful representation of individual taxpayer in U.S. Tax Court relating to classification of wages resulting in a full concession adopting the taxpayer’s position

- Favorable resolution of litigation in connection with challenges to county appraisal district’s proposed tax valuation of major energy company administrative headquarters

- Favorable resolution of litigation involving purported property tax situs of company vehicular fleet

- Favorable resolution of litigation involving property tax situs of international airlines’ fleet

- Counseling clients on asserting tax refund claims for overpayment of fuels and income taxes

- Representation of individual and corporate taxpayers in administrative matters before the Internal Revenue Service in audits, examinations, and Collection Due Process hearings

Nonprofit/ Tax Exempt Organizations

- Formed nonprofit entities and secured favorable determinations by the Internal Revenue Service of tax-exempt status

- Counseling clients on governance and compliance matters

Tax Planning

- Counselling clients on cross-border structuring incorporating business, income and estate tax planning to minimize overall global tax liability

- Consulting with non-U.S. investors on business structure and operations to maximize business opportunities while minimizing overall tax liability and ensuring compliance with applicable obligations

Federal Tax Compliance

- Performed applicable research and prepared thousands of individual, corporate, and partnership federal, state, and city income tax and federal and state employment tax returns

- Counselling tax professionals in the tax compliance aspect of federal and state tax issues

CONSTRUCTION

- Represented an owner, a governmental entity, in a construction defects action brought against the architects, engineers, and contractors resulting in a full recovery of the relevant insurance policies

- Defended an engineer against allegations of design defects in a series of commercial projects throughout the State of Texas resulting in a very favorable nuisance settlement

- Defended an architect against allegations of design defects in a custom residential project resulting in a favorable nominal nuisance settlement

SPECIAL MASTER

- Appointed as a Special Discovery Master in over two dozen commercial construction cases by multiple state district courts to assist the courts in resolving discovery disputes

- Appointed as a Discovery Master in an automotive products liability action brought against a global automaker and a well-known industry supplier of technology

- Appointed as a Special Master to issue a Report and Recommendation to the Court on the applicability of privacy restrictions to the production of detailed medical and financial records

RECEIVERSHIPS

- Appointed as a Receiver to preserve the marital estate, including the management and operation of the family’s statewide ambulance business monitoring and approving only reasonable and necessary business expenses

- Appointed as a Receiver to gather financial information and related data to provide the court with valuations for several ongoing energy-related businesses located throughout North America

- Appointed as a Receiver to collect a judgment rendered against an ongoing health care business

- Appointed as a Receiver to preserve the marital estate, including managing and operating the family’s extensive real estate development business, and to manage and initiate litigation to preserve and maximize the value of the estate

- Selected as a Receiver for the benefit of a European creditor to preserve the collateral securing large loans advanced to a health care practice, including liquidating assets to satisfy the debt

- Selected as a Receiver for the benefit of a nationwide lending institution to preserve collateral and maximize its value, including the management and operation of an apartment complex located in deep South Texas

PERSONAL INJURY

- Secured a multi-million dollar recovery for the surviving family members of a deceased in a wrongful death and survivorship action resulting from a tractor-trailer collision

- Defended a nationwide transportation company in deep South Texas and obtained a fully favorable verdict and judgment exonerating its driver and the company from allegations of negligence

- Represented an individual severely injured in a vehicular collision with a tractor-trailer owned by a nationwide transportation company and accepted a substantial settlement during the jury trial

- Prosecuted a medical malpractice and medical device products liability action resulting in the health care provider’s insurance carrier tendering its full policy limits as well as an abundant settlement by the device manufacturer

- Defended a nationwide poultry company in deep South Texas and obtained a defense verdict and judgment exonerating the company and its driver from allegations of negligence

Professional Affiliations

- American Law Institute - elected member

- American Board of Trial Advocates

- State Bar of Texas - Board of Directors; Council - ADR Section

- Hispanic National Bar Association - former National Membership Chair

- Mexican American Bar Association - former State Treasurer

- National Association of Certified Valuation Analysts

- Institute for Transnational Arbitration

- American Arbitration Association - Roster of Neutrals

- American Health Lawyers Association - Roster of Neutrals

- Hispanic Bar Association of Houston - Board of Directors

- Texas Bar Foundation - Fellow

- St. Thomas More Society of Houston - President (2020-2021), Member

News

News

- Law360’s 2023 Texas Editorial Advisory Board appoints David CalvilloSeptember 21, 2023

- 2023 Texas Super Lawyers includes Chamberlain Hrdlicka AttorneysSeptember 18, 2023

- David Calvillo featured in January issue of the Texas Bar JournalJanuary 4, 2023

- Houstonia names 30 Chamberlain Hrdlicka attorneys as 2022 Top LawyersNovember 30, 2022

- 2022 Texas Super Lawyers includes Chamberlain Hrdlicka AttorneysSeptember 21, 2022

- David Calvillo receives State Bar of Texas Board Leadership AppointmentsJuly 14, 2022

- David Calvillo, Erica Opitz, and Kellen Scott elevated to Equity Shareholders and Patrick McCann, Steven Wyatt, and Kelly Shields to ShareholdersFebruary 14, 2022

- Houstonia names Chamberlain Hrdlicka attorneys as 2021-2022 Top LawyersHoustonia, December 1, 2021

- Appellate Law Blog launched at Chamberlain HrdlickaSeptember 30, 2021

- Texas Super Lawyers names Chamberlain Hrdlicka Attorneys to 2021 ListSeptember 21, 2021

- David Calvillo is Reappointed to Roster for American Arbitration AssociationSeptember 9, 2021

- Houstonia Magazine names Chamberlain Attorneys as 2021 Top LawyersHoustonia Magazine, November 30, 2020

- Super Lawyers names Chamberlain Hrdlicka Attorneys as 2020 Texas Super LawyersOctober 19, 2020

- David Calvillo cited in Wall Street Journal on Vaccine Court CaseOctober 11, 2020

- Chamberlain Hrdlicka Tax Alert - Paycheck Protection Program (PPP) Loan Forgiveness Tax IssuesMay 21, 2020

- Law360 Names Attorneys Who Moved Up the Firm Ranks in Q1April 28, 2020

- Texas Border Business, February 19, 2020

- February 13, 2020

- December 2019

- Texas Lawyer, November 2019

- October 30, 2019

- October 2019

- Attorneys with national law firm Chamberlain Hrdlicka have been selected to the 2019 Texas Super Lawyers listSeptember 3, 2019

- May 21, 2019

- December 2018

Presentations

Seminars & Presentations

- Chamberlain Hrdlicka Brownsville Tax and International Business Planning Seminar at the Rancho Viejo Resort & Country Club on May 25, 2023May 25, 2023

- Norris Conference Center at City Centre, October 30, 2019

- Home Ownership Center, March 4, 2019

- “Big Brother Is Still Watching You: An Overview of the Disciplinary Regime Bearing Upon Tax Practitioners”- by David N. Calvillo & George W. Connelly, Jr.- Chamberlain Hrdlicka 42nd Annual Tax & Business Planning Seminar- (2019)

- “Qualified Opportunity Zones: What We Know and Don’t Know”- presented along with others- Chamberlain Hrdlicka Tax & Planning Seminar- RGV (2019)

- “In The Eye of the Beholder: The Art of Business Valuation”- Chamberlain Hrdlicka 39th Annual Business and Tax Seminar- (2016)

- “Tips and Tricks for ADR practitioners”- State Bar of Texas Minority Counsel Program- (2016)

- “ADR 101- Nuts and Bolts of Arbitration Advocacy”- State Bar of Texas- ADR Section (2015)

- “Resolving Business Disputes: Now You’re Talking My Language” UNIVERSITY OF TEXAS - PAN AMERICAN, University of Texas - Pan American, Legal Spanish - Massive Online Open Course (2013)

- “The Use of Testifying Experts in Civil Litigation” UNIVERSITY OF TEXAS - PAN AMERICAN, University of Texas - Pan American, Forensic Accounting Course, Edinburg, Texas (2011)

- “Texas Receiverships - A Survey” STATE BAR OF TEXAS, Every Marriage In Texas Ends In Divorce or Death, McAllen, Texas (2010)

- “Arbitration – Panacea or Burden?” STERLING EDUCATION SEMINARS, INC., Employment Law Update: Employment Arbitration & Mediation Agreements - Mandatory Vs. Voluntary, Brownsville, Texas (2009)

- “Technology in the Law Office & Courts” STATE BAR OF TEXAS, Texas Minority Attorney Program, South Texas College, McAllen, Texas (2009)

- “Successfully Settling Complex Cases at Mediation - Observations from ‘Behind the Curtain’” STATE BAR OF TEXAS, Soaking Up Some CLE- A South Texas Litigation Course, South Padre Island, Texas (2009)

- “Understanding the Issues in Texas, Arbitration – Panacea or Burden?” LORMAN EDUCATIONAL SEMINARS, The Fundamentals of Construction Contracts, McAllen, Texas (2007)

- “Mediation Advocacy: Exploring Ethical Limits” STATE BAR OF TEXAS, Soaking Up Some CLE - A South Padre Litigation Seminar, South Padre Island, Texas (2007)